Overview

We offer both Individual Risk Facultative and Facultative Automatics solutions.

Individual Risk Facultative – Designed for risks that sit above a client’s retention or appetite, with tailored support, within 24 hours

Facultative Automatics – Built for scale, allowing cedants to place high volumes of qualifying risks under pre-agreed terms, cutting frictional costs and driving efficiency through consistency.

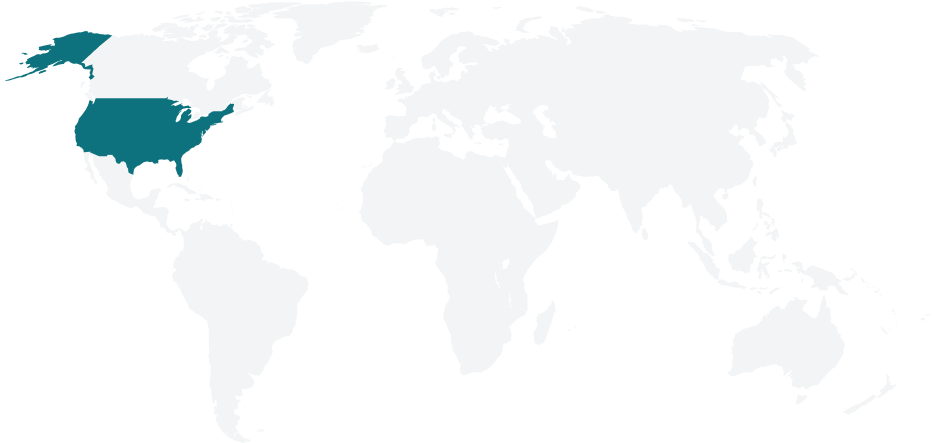

Regions covered

North America

Risk Appetite

We cover more, so you can place more. Our appetite includes:

- Real Estate

- Apartments / Condos

- Manufacturing

- Homeowners

- Schools

- Retail

- Hotels

- Municipalities

- Storage / Distribution

Coverage and Limits

- Maximum line size is USD 7.5m any one risk or automatic

Portfolio manager

Paul Amrose

President and Head of Facultative Reinsurance, North America