Overview

Led by Mark Hynds, a proven Lloyd’s underwriter, our Contingency portfolio focuses on low-risk, non-catastrophic event business, with an appetite for indoor events, ticket refunds and major sporting events. By combining technical expertise, strong underwriting discipline and analytics, we target consistent profitability, and our growth plan is built on precision and performance.

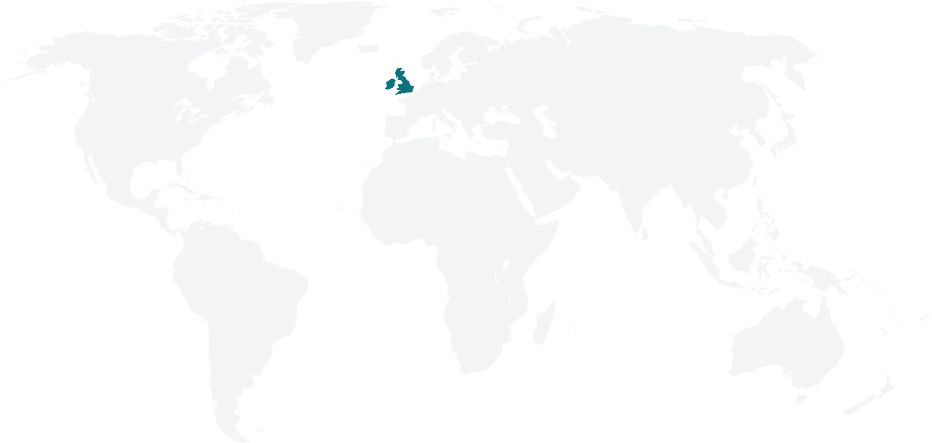

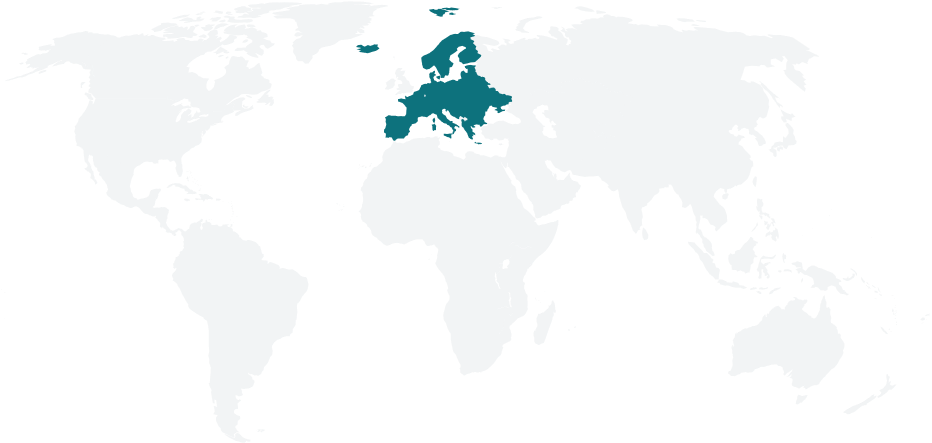

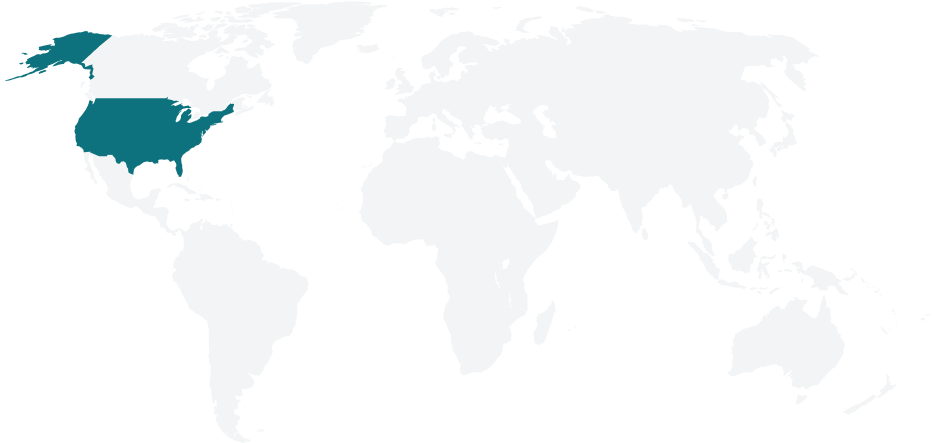

Regions covered

UK

Europe

North America

Risk Appetite

- Indoor Cancellation & Abandonment (including conferences, exhibitions, lunches and dinner parties)

- Ticket Refund Business

- Major Sporting Events

- Temporary Structure Cancellation & Abandonment

- Outdoor Cancellation and Abandonment

- General Event Cancellation

- Film Producers

- Death, Disability and Disgrace

- Transmission Failure

- Excess Layers or Non Appearance

- Theatrical Tours / Residences

- Major Non Appearance Tours (subscription basis)

- Small Non Appearance Risks

- Weather Day

- Hole in One

Coverage and Limits

- Line Size: GBP 5m