Overview

Rokstone specialises in Directors and Officers insurance for non-standard and complex risks, from SMEs to mid-market and multinational organisations. With a sharp focus on clients in the UK, EEA and Caribbean, our tailored solutions protect decision makers against today’s regulatory challenges. Backed by autonomous authority and a panel of leading capacity providers, we give leadership teams the confidence that their protection is built to last.

Regions covered

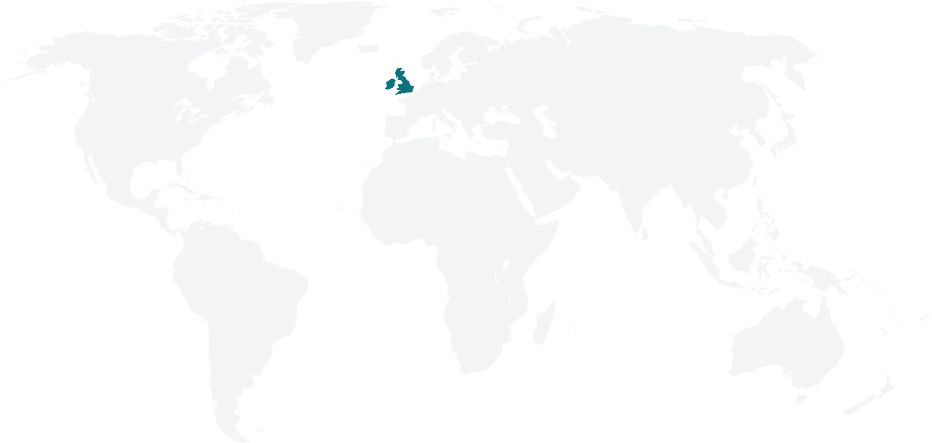

UK

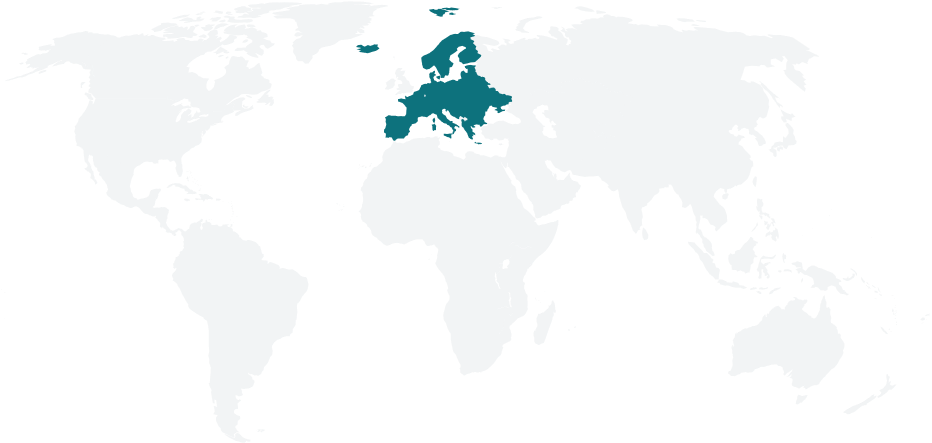

Europe

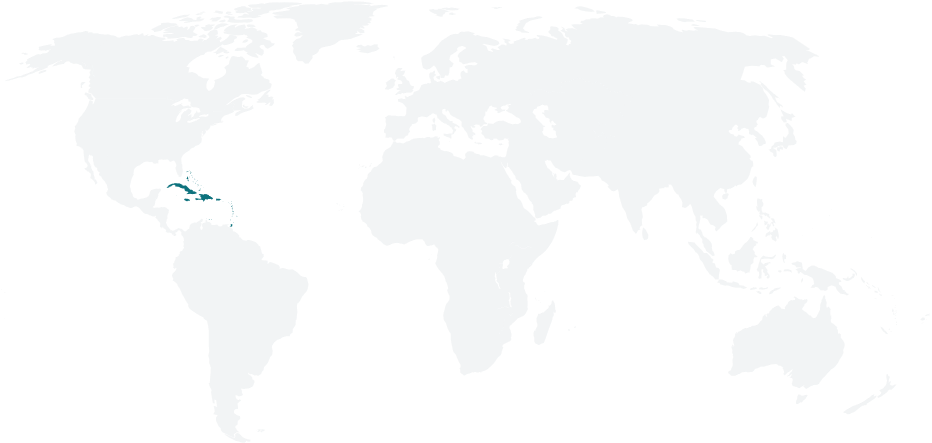

Caribbean

Products

Choose a product:

Commercial Institutions

Overview

We provide specialist D&O cover for Commercial Institutions, from complex SME risks to mid-market and multinational organisations. Our underwriting approach is built on speed, flexibility and sustainability, designed to adapt to the evolving challenges businesses face today. Every policy is backed by Lloyd’s of London capacity, giving brokers and clients the assurance of credibility and global reach.

Risk Appetite

We like challenges. Almost all industry sectors are considered, with each risk judged on its own merits.

- Agriculture

- Biotech and Pharmaceutical

- Charities and Non-profits

- Construction and Engineering

- Education

- Energy

- Financial (including Financial Institutions

- Healthcare

- Legal

- Manufacturing

- Mining (non-coal)

- Professional

- Property

- Retail and Wholesale

- Sports

- Transport and Logistics

- Utilities and Infrastructure

Coverage and Limits

We offer a range of covers and products as broad as our risk appetite.

- Directors and Officers Liability

- Management Liability, made up of; D&O, CLL, EPL and Crime

- Pension Trustee Liability

- Family Trust Liability

- Line size up to GBP/EUR/USD 10,000,000.

Document Downloads

Claims Info:

Claims handling is undertaken by an experienced and specialist team at RPC.

Financial Institutions

Overview

We deliver tailored solutions for Financial Institutions, with an appetite that spans FI D&O, Professional Indemnity and Crime. Our agile underwriting is built for long-term resilience in a highly regulated and high-stakes environment. Every risk is underwritten on behalf of Lloyd’s of London, giving clients the strength, stability and global recognition they need to operate with confidence.

Risk Appetite

We like challenges. Almost all industry sectors are considered, with each risk judged on its own merits.

- Asset Managers

- Banks and Building Societies

- Corporate Finance Advisors

- Corporate Service Providers

- Deposit and Savings Institutions

- E-Money Institutions and E-Wallet Providers

- Family Offices and Private Trust Companies

- Insurance Companies (including captives)

- Investment Funds and Asset Holding Vehicles

- Investment Managers and Administrators

- Loans and Lending Institutions

- Mortgage Brokers and Lenders

- Payment Processors

- Private Equity and Venture Capital

- Real Estate Investment Trusts (REIT)

- Settlement and Clearing Institutions

- Stockbroking

- Trust Administration

Coverage and Limits

We offer a range of covers and products as broad as our risk appetite.

- Directors and Officers Liability

- FI Professional Indemnity

- Crime

- Pension Trustee Liability

- Fund D&O and IMI package

- Line size up to GBP/EUR/USD 5,000,000

Document Downloads

Claims

Claims handling is undertaken by an experienced and specialist team at RPC.

Portfolio manager

Jimmy Heaton

Head of International D&O and Financial Institutions

What limit does your client need?

At Rokstone, innovation is built into how we deliver better outcomes for brokers and their clients. Our new Limit of Indemnity (LOI) Benchmarking Tool takes the guesswork out of choosing cover, providing clear, data-backed guidance on the right level of cover.

By combining underwriting insight, actuarial expertise and commercial litigation data, the tool provides a smarter way to assess client needs. The dropdown options are aligned with our D&O underwriting appetite, ensuring recommendations that are both relevant and practical, designed with commercial institutions across the UK, EEA and Caribbean in mind.